Money Laundering with Traveller’s Cheques

Can Traveller’s cheques be used to launder money? – An AML/CTPF impact analysis on traveller’s cheques

Rahn Consolidated (Pty) Ltd’s (“Rahn Consolidated”) articles and case studies are aimed at socialising, climatising, creating awareness and cautioning economic participants on regarding economic crime schemes. The focus will inter alia be on the investigations around Money Laundering with Traveller’s Cheques, risks, reporting and most importantly, its regulatory compliance. The term “Economic crime schemes” are often used interchangeably with “Financial Crime”. For the purpose of ensuring all readers are kept in the loop, Rahn Consolidated will make use of both terms. Rahn Consolidated being at the forefront of deterring Financial Crime through compliance will focus primarily on the compliance of regarding Financial Crime and ensuring fines by way of administrative sanctions that fines are mitigated as much as possible.

Issue No.16 focuses broadly on the non-banking system that deals with new payment products and services (NPPS). Entities in this industry are still labelled as financial institutions which are issuing and managing different means of payment. These means of payment may include, credit and debit cards, cheques, traveller’s cheques, money orders and bankers’ drafts and electronic money.

The Money laundering and Terrorist financing risks around this area are large require extensive controls to ensure compliance to all AML/CTF laws. This article aims to reflect the AML requirements considering how this particular payment system could be susceptible to money laundering.

Enjoy the Read!

Item 13 of Schedule 1 of the Financial Intelligence Centre (FIC) Act identifies an entity which issues, sells or redeems traveller’s cheques, money orders or similar instruments as an Accountable Institution (AI). When looking into new payment product systems, with reference to traveller’s cheques, the following must be considered:

Traveller’s cheques providers should consider putting in place transaction monitoring systems which can detect suspicious activity based on money laundering and terrorism financing typologies and indicators. Such monitoring systems should take into consideration customer risks, country or geography risks, and product, service transaction or delivery channel risks. The transaction monitoring system could also be used to identify multiple accounts or products held by an individual or group, such as holding multiple traveller’s cheques. Traveller’s cheques providers should consider analysing the information and records retained to determine unusual patterns or activity. Where the traveller’s cheque provider identifies a transaction which it suspects, or has reasonable grounds to suspect, that the funds involved are the proceeds of criminal activity or are related to terrorist financing, it should report its suspicions to the relevant financial intelligence unit in accordance with the FATF Recommendations and the laws in the applicable country.

FATF new payment products RBA

As AIs, Traveller’s cheque businesses are not limited to only reporting obligations but should at a minimum comply with the below:

- Register business as an AI with the FIC in order to ensure regulatory reporting through go-AML;

- Develop a Risk Management and Compliance Programme (RMCP);

- Conduct Customer Due Diligence (CDD);

- Develop a compliance framework and appoint a compliance officer;

- Conduct training on AML/CTPF risks and controls;

- Effectively keep records; and

- Effectively submit regulatory reports to the FIC.

FIC’s website: https://www.fic.gov.za

From a reporting perspective, the traveller’s cheques industry only constitutes about 3% of the total reports submitted between 2021/2022 by different accountable institutions and reporting institutions (AI and RI). This implies 3% of 5 247 362 repots received by the FIC.

It was further reported that from a traveller’s cheque perspective, most reports relate to suspicious activities and transactions (SAR/STR). To quantity the above, above 81 964 reports are received from the NPPS alone which includes traveller’s cheques. This makes it about 21% of the total SAR/STR received for different types of AIs and RI for the period 2020/2021.

The above indicates the importance of this industry and how badly it could be susceptible to money laundering.

“It is imperative for this industry to focus largely on detective controls enabling their reporting.”

Rahn Consolidated can assist cash intensive AIs in developing and implementing bespoke transaction monitoring systems and processes to drive out compliance and financial crime controls. This ensures that the SAR/STR reporting reflects the true risk within the organisation and not simply making use of generic approaches which typically over-simplify and over-estimate risks within a particular organisation.

Money Laundering Risks identifies in these payment systems:

Money Laundering with Traveller’s Cheques has increased by allowing cash funding and, in some rare cases, convertibility without any limit on the value placed on the cheque or CDD requirements. This makes traveller’s cheques vulnerable to abuse by criminals who can use them, for example, to launder the proceeds of crime by placing those proceeds into the financial system or using the traveller’s cheques as an

alternative to the physical cross-border transportation of “converted” cash. Mobile payment services (which can be described in the same group as traveller’s cheques) allow accounts and transactions to be funded in diverse ways; many services, whether bank- or centric based models, draw funds from a bank or payment card account, others allow cash funding through a network of agents. While the former

funding method limits ML/TF risks (but also limits potential access), cash and non-bank payment options obscure the origin of the funds creating a heightened risk for ML/TF. A mobile payment service that facilitates account-to-account transfers is also permitting funding through third parties, which may increase the ML/TF risk, if the holder of the funding account was not properly identified.

ML/TPF Risks Case study: Traveller’s cheque (payment systems AI registration)

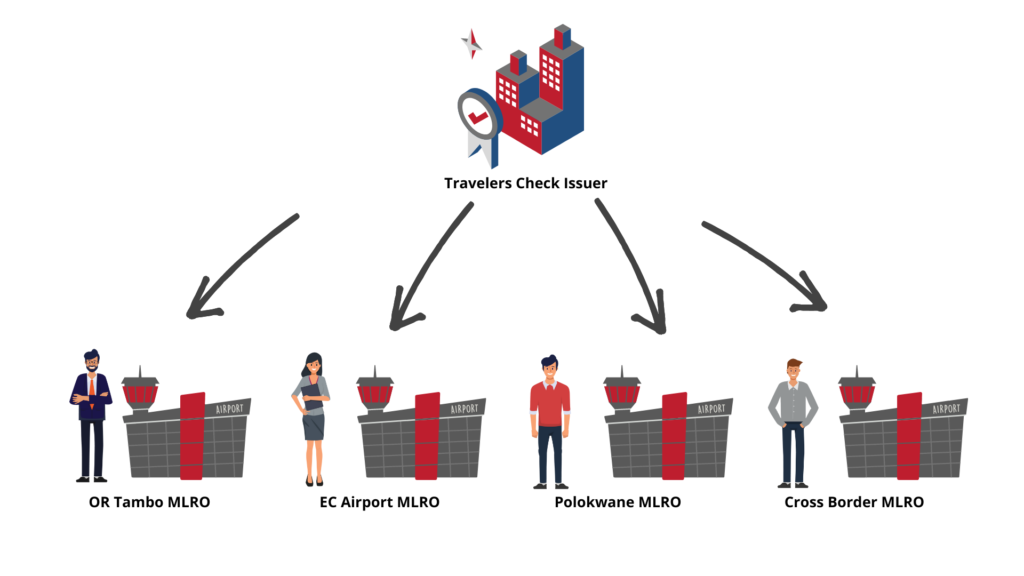

Example of Traveler’s cheque registration and its structure

An entity’s main line of business is that of an issuer of traveler’s cheques as defined in the schedule 13 of the FIC Act. Below indicates how registration would occur, especially if the payment product system is non-banking.

Mr. X is the compliance officer of all 4 accountable institutions, see diagram below. It is important to note that reporting to the Centre follows the registration structure of the accountable institution (s). Multiple MLRO can be added per registration structure i.e., per schedule item. The MLRO is registered under the main line of business he/she can see all registration and reporting information. If the MLRO is registered for an underlying schedule item only he/she can only see reporting and registration information of that schedule item. N/B: Fictitious structure for illustration purposes.

PCC 05B