Estate Agent Money Laundering – RAHN CASE STUDY ISSUE NO.6-2022

Settling the Anti-Money Laundering (“AML”) Laundry Machine in your Property A study on estate agents and Financial Intelligence Centre (“FIC”) Act Compliance

Rahn Consolidated (Pty) Ltd’s (“Rahn Consolidated”) articles and case studies are aimed at creating awareness and cautioning economic participants regarding economic crime schemes. The focus will inter alia be on the investigations around economic crime schemes, risks, reporting and most importantly, regulatory compliance. The term “economic crime schemes” are often used interchangeably with “financial crime”. For the purpose of ensuring all readers are kept in the loop, Rahn Consolidated will make use of both terms.

Rahn Consolidated being at the forefront of deterring Financial Crime through compliance will focus primarily on the compliance regarding Financial Crime and ensuring by way of administrative sanctions that fines are mitigated as much as possible.

Issue No.6 focuses on professionals involved with the selling and buying of real estate. Role players such as real estate agents and brokers are required to remain compliant. Estate Agents are Accountable Institutions (AIs) as contemplated in schedule 1 of Financial Intelligence Centre Act (FIC Act), as amended.

Estate Agents should also be aware that they could easily be used as vehicles to launder money that are proceeds of criminal activities. They also need to be alert to the fact that they could be used alongside other Accountable Institutions (AIs) such as Legal Practitioners to launder money. As a result, FIC Act requirements and obligations such as reporting should always be looked into as a dual mandate for AIs.

Enjoy the Read!

Criminals usually approach industries that apply less comprehensive regulation and mitigation measures and where basically they simply don’t want to comply. This is mostly due to misunderstanding of the regulations and what is expected of them or simply ignorance. The Estate Agent industry, as AIs has to ensure it implements money laundering control measures in terms of all requirements contemplated in the FIC Act.

Just to put Estate Agents into context!

Cases related to Estate Agents are mostly around illicit funds emanating from criminal activities being used to purchase property and the estate agents not taking corrective measures to conduct customer due diligence (CDD) on the clients they are building a business relationship with.

One case once dealt with is where a Ponzi Scheme was established (predicate offence) with the intention of purchasing private property worth millions. Due to this particular Estate Agent having money laundering controls in place, it established a business relationship with the clients from the Ponzi scheme but as part of its CDD procedures, it sent the client to the lawyers for conveyancing.

During the conveyancing, it was discovered by the lawyer that the client was involved in a Ponzi scheme and was being investigated for fraud. The lawyer and the estate agent suspected that the money to purchase the property was illicit and therefore reported the matter in a Suspicious Transaction Report (STR). The compliance of these 2 AIs eventually led to the property being frozen and the proceeds being taken back to the rightful source.

Reasons for Estate Agents being susceptible to Money Laundering and Terrorist Financing risks

Unlike banking, insurance and other AIs, buyers and sellers of real estate don’t intend to maintain a relationship over a period of time with AIs.

This makes it difficult for estate agents to conduct ongoing-due diligence (ODD) and for regulators and supervisors to pick up inconsistencies.

- The nature of transactions in the estate agents space reduces the level of understanding of customer profiles as most encounters are are limited to single transactions.

- Estate agents do not usually collect beneficial ownership details to conduct client identification and verification (CIV) .

- This type of business allows movement of large sums of money and also to conduct single once off transactions.

As an AI, Estate Agents are not limited to only reporting obligations but should at a minimum comply with the following:

- Register business as an AI with the FIC in order to ensure regulatory reporting through go-AML;

- Develop a Risk Management and Compliance Programme (RMCP);

- Conduct Customer Due Diligence (CDD);

- Develop a compliance framework and appoint a compliance officer;

- Conduct training on AML/CTPF risks and controls;

- Effectively keep records; and

- Effectively submit regulatory reports to the FIC.

FIC’s website:https://www.fic.gov.za

Although there are lots of risk factors associated with money laundering as Estate Agents, it is quite encouraging to observe the number of Estate Agents that are registered with the regulator.

The Financial Intelligence Centre (FIC) has been very successful over the years in driving the registration awareness for all AIs including Estate Agents. Estates agents are one of the largest registered AIs with the FIC. In the past 2 years, registration has moved from 10 242 to 10 444 which indicates the awareness of Estate Agents being AIs. As already alluded even in previous issued articles, registration alone does not constitute compliance.

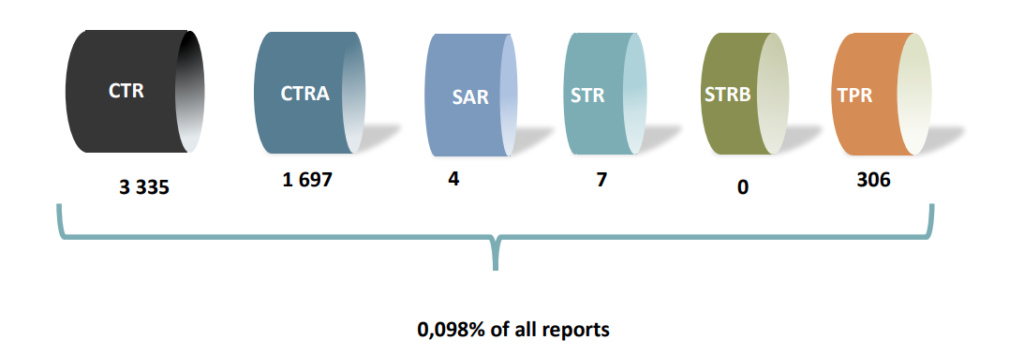

According to the FIC, below are reports submitted by Estate Agents in the past 2 years:

“The lawyer and the estate agent suspected that the money to purchase the property was illicit and therefore reported the matter in a Suspicious Transaction Report (STR).”

Legal Practitioner advising on purchase and sale of real property

Background

The real Estate industry is very susceptible to abuse and can therefore assist criminals to launder their illicit proceeds from criminal activities. Once they layer the money through the system their motive is always for profit gain.

Modus Operandi

Below are activities that criminals would use to launder money through Estate Agents:

- Use of complex loans;

- Use of client accounts;

- Use of monetary instruments;

- Manipulation of the appraisal or valuation of property;

- and Construction and renovation of real estate

The duties of an Estate Agent

The duties of an Estate Agent in this instance lies in performing simple/standard due diligence on the seller of real property , when acting for the buyer and seller and the buyer appears to be a related party. This forms part of due diligence that needs to be performed by this AI.

Administrative Sanctions and Financial Penalties

Lack of performing customer due diligence by the legal practitioners conducting such activities will lead to administrative sanction as per below:

- R10 Million (Natural person);

- R50 Million (Legal person)

- There are no criminal sanctions applicable.