Anti-Money Laundering – RAHN CASE STUDY ISSUE NO.18-2022

Anti-Money Laundering/Counter-Terrorist and Proliferation Financing (AML/CTPF) impact on multifaceted business

A study on Ithala’s impact on AML/CTPF

Rahn Consolidated (Pty) Ltd’s (“Rahn Consolidated”) articles and case studies are aimed at socialising. Climatising, creating awareness and cautioning economic participants regarding economic crime schemes. The focus will inter alia be on anti-money laundering and the investigations around economic crime schemes. Risks, reporting and most importantly, its regulatory compliance. The term “Economic crime schemes” is often used interchangeably with “Financial Crime”. For the purpose of ensuring all readers are kept in the loop, Rahn Consolidated will make use of both terms. Rahn Consolidated is at the forefront of deterring Financial Crime through compliance. They will focus primarily on compliance regarding Financial Crime. They will ensure fines by way of administrative sanctions that fines are mitigated as much as possible.

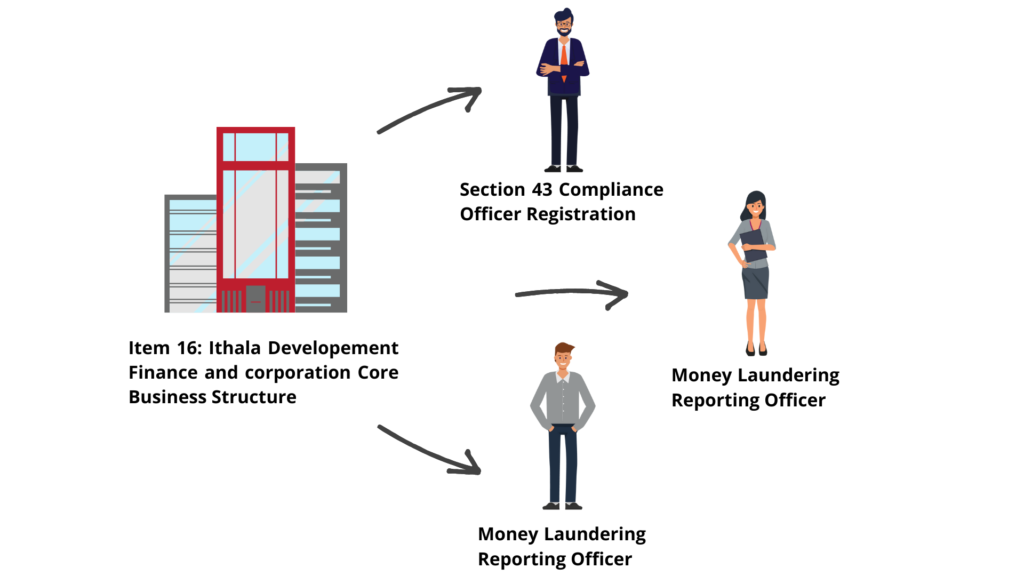

Item 16 of Schedule 1 of the Financial Intelligence Centre (FIC) Act. Identifies Ithala Development Finance Corporation Limited as an Accountable Institution (AI).

The Corporation’s core strategic objectives are to mobilise financial resources, provide financial and supportive services, to assist with planning, execution, financing and monitoring of the implementation of development projects and programs. Their objectives include assisting and encouraging the development of human resources and social, economic, financial and physical infrastructure. They also seek to encourage and facilitate private sector investment and the

participation of private sector and community organisations in development projects and programs. It is in their best interest to ensure that they are contributing to economic growth and development and act as the government’s agent for performing any development-related tasks and responsibilities that the government considers may be more efficiently or effectively performed by a corporate entity. From a Financial Action Task Force perspective, Public Financial Institutions

operating in South Africa, though not material in terms of size, are relevant due to their customer numbers and the access to the financial infrastructure they provide. These include Ithala SOC Limited, the banking and insurance subsidiary of Ithala Development Finance Corporation Limited, owned by the province of KwaZulu-Natal, whose customers are mostly government employees of the province. Both entities operate under an exemption to provide banking services without a license.

FATF MER Recommendations

As an AI, Ithala Development Finance Corporation is not limited to only reporting obligations but should at a minimum comply with the following:

- Register business as an AI with the FIC in order to ensure regulatory reporting through go-AML;

- Develop a Risk Management and Compliance Programme (RMCP);

- Conduct Customer Due Diligence (CDD);

- Develop a compliance framework and appoint a compliance officer;

- Conduct training on Anti-Money Laundering / CTPF risks and controls;

- Effectively keep records; and

- Effectively submit regulatory reports to the FIC.

FIC’s Website https://www.fic.gov.za

ML/TPF Risks Notes (Ithala Development Finance Corporation)

Deposit-taking financial institutions

The South African banking sector is dominated by five large banks, which collectively held 90.5% of the total banking sector assets as of 31 March 2019 (31 March 2018: 90.2%).

Local branches of international banks accounted for 5.6% of banking sector assets at the end of March 2019 (March 2018: 5.9%), while other banks represented 3.8% at the end of March 2019 (March 2018: 3.9%). Note: Banking sector data includes Ithala SOC Limited, conducting banking business in terms of an exemption from the provisions of the Banks Act.

Ithala SOC Limited must register as per the license issued. The business of Ithala SOC is based on principles of branch business and most activities conducted in the financial industry. All offices or branches should be in a position to provide advice and administrative services to their clients. It is therefore not required that each individual branch registers on its own.

Ref: PCC05B